In forex trading, understanding the nuances of position sizing is crucial. Micro lots offer an ideal entry point for risk-conscious traders, especially beginners looking to trade in a real market environment without committing large capital. This guide walks you through the fundamentals, applications, and strategic value of micro lots in the broader context of forex trading.

What Is a Lot in Forex Trading?

A lot is the standardized quantity of currency units you’re buying or selling in a forex trade. It defines your position size and directly influences both your potential profit and the risk exposure.

There are four main lot types in forex:

- Standard Lot: 100,000 currency units

- Mini Lot: 10,000 currency units

- Micro Lot: 1,000 currency units

- Nano Lot: 100 currency units

Micro lots are especially popular among retail traders because they allow participation in the market with minimal capital at risk.

Understanding Lot Sizes in Forex: Key Comparisons

Table: Lot Size Comparison

| Lot Type | Units | Pip Value (USD/JPY) | Typical Users |

| Standard Lot | 100,000 | ~$10 | Institutional/Pro Traders |

| Mini Lot | 10,000 | ~$1 | Intermediate Retail Traders |

| Micro Lot | 1,000 | ~$0.10 | Beginners & Risk Managers |

| Nano Lot | 100 | ~$0.01 | Strategy Testers |

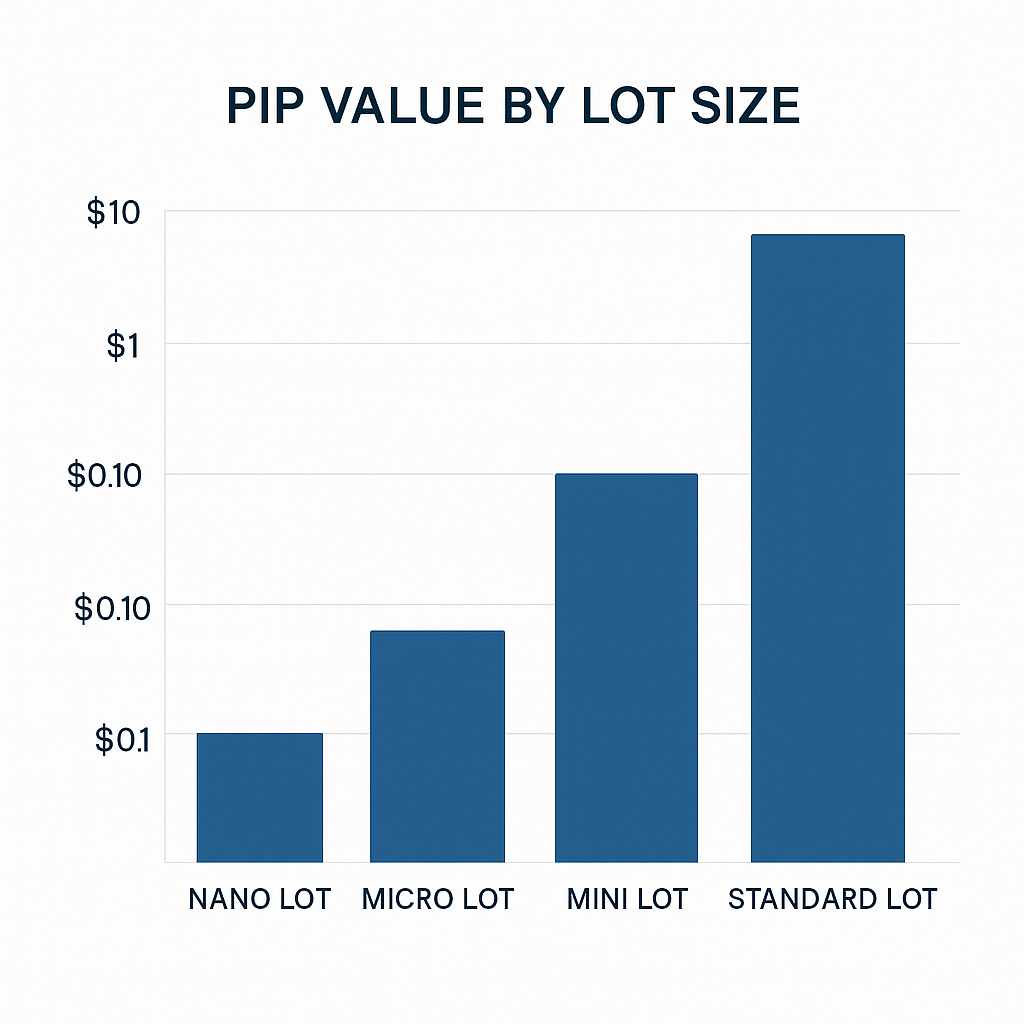

Chart: Pip Value by Lot Size

This comparison shows how pip value scales with lot size—key for understanding how gains and losses accumulate.

Calculating Lot Size: Methods & Formulas

Risk-Based Lot Size Calculation

A widely used formula for calculating position size is:

Lot Size = (Account Risk in $) / (Stop Loss in Pips × Pip Value)

This ensures traders do not exceed their predefined risk tolerance.

Margin Impact

Lot size also affects margin requirements. A micro lot typically requires much less margin than larger positions, making it more accessible for smaller accounts and conservative traders.

Benefits and Drawbacks of Micro Lot Trading

Pros:

- Controlled Risk Exposure: Limits losses while learning or testing strategies.

- Affordable Entry: Ideal for those with small capital.

- Flexible Strategy Testing: Traders can test systems under real market conditions.

Cons:

- Lower Profit Potential: Earnings are proportionally smaller.

- Slower Account Growth: Compounding takes longer unless capital is increased.

Who Should Use Micro Lots?

Micro lots are ideal for:

- Beginners learning real-time market behavior.

- Low-balance traders wanting to control exposure.

- Strategy testers simulating performance with small capital before scaling up.

They provide an excellent balance of learning opportunity and capital protection.

How to Start Trading Micro Lots

1. Choose a Broker

Opt for brokers that offer micro accounts with low spreads, strong regulation, and reliable execution (e.g., XM, Exness, RoboForex).

2. Open and Fund Your Account

Register with your broker, verify your identity, and deposit funds. Most micro accounts allow minimum deposits from $5 to $100.

3. Place Your First Trade

Use MT4/MT5 or the broker’s native platform. Set a small position (e.g., 0.01 lots), apply a stop-loss, and monitor your risk and exposure.

FAQs on Micro Lots

Can I switch between micro and standard lots?

Yes, depending on your account type and broker settings, you can switch position sizes manually or by changing account tiers.

What’s the minimum deposit for micro trading?

It varies by broker but typically ranges between $5 and $100.

Do brokers allow leverage on micro accounts?

Yes, leverage is usually available and can range from 1:30 to 1:1000. However, high leverage should be used cautiously.

Are demo and micro accounts the same?

No. Demo accounts use virtual funds for practice. Micro accounts use real money but allow trading in small units.

Can I manage risk effectively with micro lots?

Absolutely. Micro lots are specifically designed to help traders manage risk with greater precision.